As global manufacturing recalibrates for quality, compliance, and resilient supply chains, industrial phosphates—

particularly Sodium Acid Pyrophosphate (SAPP) and Tetrasodium Pyrophosphate (TSPP)—remain indispensable in food processing, metal treatment,

water conditioning, and cleaning formulations. This report distills market forces, application trends, regulatory expectations, and sourcing playbooks

to help procurement leaders and technical teams make better decisions. Authored by GJ Phosphate.

Executive Summary

The phosphate chemicals market remains structurally supported by diversified end-use demand and a steady innovation pipeline,

even as buyers contend with shifting logistics and compliance requirements. Within this landscape, SAPP is prized for its controlled

leavening performance, pH adjustment, and sequestration behavior in food systems, while TSPP is valued for dispersion, buffering,

chelation, and deflocculation across cleaning, ceramics, and metalworking fluids. For 2025, B2B buyers should prioritize

supplier reliability, documentation depth (food and technical grades), and application-matched specifications to manage cost-in-use—not just unit price.

- SAPP remains a critical leavening acid in bakery and processed meat, with grade selection (e.g., SAPP 15/28/40) tuned to gas release timing.

- TSPP provides robust sequestration and dispersing functions in detergents, water treatment, and ceramic slips, improving process yield and stability.

- Documentation matters: food-grade certifications, allergen statements, HACCP/GMP, and CoAs should be standard.

- Secure multi-origin logistics, packaging flexibility (25 kg bags to jumbo bags), and forecast-based allocations.

- Adopt cost-in-use metrics—evaluate performance dosage, not only price per kg.

Market Trends in 2025

1) Demand Diversification

End-use diversification underpins steady consumption. In food processing, SAPP supports consistent texture and color retention in cured meats

and enables predictable leavening rates in baked goods. Technical segments—including home care, institutional cleaning (I&I), and water treatment—

rely on TSPP’s dispersing and chelating power to stabilize formulations and enhance cleaning efficacy.

2) Quality & Compliance as Growth Drivers

Buyers are raising the bar on documentation and traceability. This trend benefits suppliers with strong quality systems and robust compliance packs—

e.g., food-grade declarations, GMP audits, CoA/CoC consistency, and change-control communication. The result is a structural shift from opportunistic spot

purchases to programmatic, audited relationships.

3) Logistics Normalization with Residual Volatility

Freight volatilities have eased compared to previous peaks, yet route disruptions and energy price swings still influence delivered cost.

Programs with quarterly or semiannual reviews help buyers adapt without constant renegotiation.

4) Sustainability as a Procurement Criterion

Environmental disclosures, energy profiles, and packaging recyclability increasingly enter RFP scoring. Inorganics like phosphates are not exempt:

buyers request data on raw material stewardship, effluent management, and waste minimization. Suppliers investing in cleaner utilities and closed-loop

water practices gain advantage.

5) Application Engineering & Cost-in-Use

Formulators assess phosphate selection based on performance at working dosage. SAPP leavening behavior and TSPP dispersion efficiency can lower total

formulation cost and reduce rework, scrap, or downtime—often dwarfing unit-price differences.

Application Landscape: SAPP vs TSPP

Selecting between SAPP and TSPP starts with a clear articulation of the application mechanism and processing window. The matrix below maps typical functions

against major industries.

| Industry / Function | SAPP (Sodium Acid Pyrophosphate) | TSPP (Tetrasodium Pyrophosphate) |

|---|---|---|

| Bakery & Dough Systems | Controlled CO₂ release for leavening; rate tuning via SAPP 15/28/40; pH adjustment for crumb structure. | Limited use; can act as buffering/sequestering aid in some premixes. |

| Processed Meats & Seafood | Color stabilization; water-binding synergism; texture uniformity; mitigates purge. | Sequestration and pH buffering; improves protein functionality in specific brines. |

| Dairy & Cheese Processing | pH control, melt characteristics in processed cheese (when combined with other salts). | Emulsifying salt component; dispersion and calcium sequestration in processed cheese blends. |

| Home & I&I Cleaning | Secondary role; occasionally pH/control in niche formulas. | Primary: sequestrant, dispersant; boosts soil removal, prevents redeposition, stabilizes surfactant systems. |

| Water Treatment | Occasional buffering use. | Scale control and dispersion; iron/manganese sequestration under specific conditions. |

| Ceramics & Slurry Processing | Limited. | Primary: deflocculant for slips; viscosity control, higher solids loading, improved casting rates. |

| Metal Treatment & Surface Prep | Secondary acid/base balancing roles. | Complexation and dispersion improve bath stability; aids in cleaner/degreaser formulations. |

Choosing SAPP Grades: SAPP 15 vs SAPP 28 vs SAPP 40

In bakery, “15/28/40” loosely indicates gas release profiles. Lower numbers generally release more CO₂ during mixing (faster system), while higher numbers

bias gas release during baking (slower system). Grade choice is therefore a function of process timing, dough temperature, and target texture.

- SAPP 15: Faster-acting; suited to quick mixes where early gas release is acceptable.

- SAPP 28: Balanced profile for mainstream baked goods and broader processing windows.

- SAPP 40: Slower-acting; optimized for extended bench time and consistent oven spring.

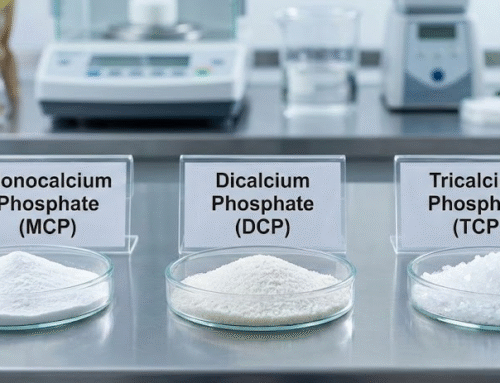

Product Grades & Specifications (Food & Technical)

Procurement should align grade selection with both regulatory scope (food vs technical) and application function. Below is a generic snapshot to guide RFQs.

Always confirm detailed specifications and tolerances with your supplier’s CoA and TDS.

Typical Food-Grade SAPP Spec Snapshot

| Assay (as SAPP) | ≥ 95% (on dry basis) |

|---|---|

| pH (1% solution) | ≈ 3.5–4.5 |

| Insolubles | ≤ 0.1% |

| Fluoride | Meets food-grade thresholds |

| Heavy Metals | Meets food-grade thresholds |

| Mesh / Particle Size | As specified (e.g., fine powder; controlled distribution for bakery blends) |

| Certifications | Food-grade declaration, GMP/HACCP, allergen-free statement, Kosher/Halal (as needed) |

Typical Technical-Grade TSPP Spec Snapshot

| Assay (as TSPP) | ≥ 95% (on dry basis) |

|---|---|

| pH (1% solution) | ≈ 9.5–10.5 |

| Insolubles | ≤ 0.2% (target) |

| Bulk Density | As specified (powder/granular options) |

| Heavy Metals | Meets technical grade thresholds |

| Particle Size | Tailored for dispersion/solubility in target process |

| Documentation | TDS, SDS, CoA; change-control policy; regulatory support letter as needed |

- CoA per lot; TDS; SDS; Food-grade declarations where applicable.

- Allergen/GM statements; Kosher/Halal certificates (if required).

- Contaminant monitoring (fluoride/heavy metals) aligned with market regulations.

- Packaging & palletization specs; storage and shelf-life conditions.

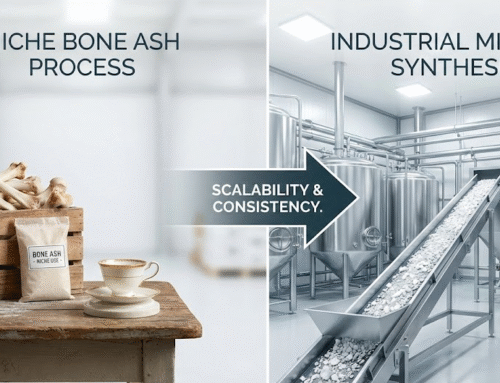

Production Technology & Quality Controls

Consistency in phosphate salts is the product of process stability and analytical rigor. Quality-conscious buyers should understand the upstream chemistry,

conversion steps, and thermal profiles that define both SAPP and TSPP characteristics.

SAPP Process Considerations

- Raw Material Integrity: High-purity sodium and phosphate inputs minimize downstream impurities.

- Thermal Control: Precise thermal treatment influences polyphosphate distribution and final leavening behavior.

- Milling & Classification: Particle-size distribution (PSD) tuning supports consistent dough rheology and CO₂ release.

- Hygiene Protocols: Food-grade lines require hygienic design, environmental monitoring, and allergen control plans.

TSPP Process Considerations

- Hydration State: Managing water of hydration impacts solubility and dispersion in end-use systems.

- Deflocculation Efficacy: Controlled chain length and purity drive performance in ceramic slips and high-solids slurries.

- Granulation Options: Granular forms can aid dust control and handling in detergents or water treatment plants.

Analytical Controls

- ICP/OES for elemental impurities.

- Ion chromatography for anion profiling.

- pH/Conductivity monitoring for batch consistency.

- Sieve analysis for PSD; Karl Fischer for moisture.

Regulatory & Compliance Considerations

Food and technical uses are governed by distinct frameworks across jurisdictions. Buyers should request an up-to-date regulatory support letter alongside

certificates. At a minimum, ensure compliance with your target market’s food additive or industrial chemical rules, labeling, and safety data standards.

Food Applications (SAPP)

- Confirm food additive status in target markets and any usage-level constraints for specific categories.

- Verify contaminant limits (fluoride, heavy metals) and microbiological criteria when relevant.

- Secure allergen, GMO, and dietary (Kosher/Halal) statements where business-critical.

Technical Applications (TSPP)

- Ensure SDS classifications align with local hazard communication standards.

- For water treatment and detergents, check regional chemical inventory requirements and discharge considerations.

- For ceramics and metalworking, align product labeling and worker protection measures with site HSE policy.

Note: Specific regulatory citations vary by jurisdiction and end-use. GJ Phosphate provides documentation packs and can complete supplier questionnaires upon request.

Supply Chain & Sourcing Strategy

The most resilient sourcing programs balance quality assurance with logistics agility. Beyond price benchmarking, leaders prioritize supplier capacity,

documentation reliability, and packaging/handling compatibility with plant operations.

Logistics & Packaging

- Standard pack sizes: 25 kg bags; 500–1000 kg FIBCs for bulk users.

- Moisture barrier and pallet integrity are essential for storage stability.

- Plan for buffer stock during seasonal freight imbalances and holiday slowdowns.

Forecasting & Allocations

- Use rolling 3–6 month forecasts to secure production windows.

- Dual-site or dual-route options reduce disruption risk.

- Quarterly business reviews (QBRs) align quality metrics and improvement actions.

Supplier Qualification

- GMP/HACCP system (food-grade lines); ISO-based quality management for technical lines.

- Traceable CoA per lot; retained sample policy; change-control procedure.

- Regulatory pack: food declarations or chemical inventory letters as needed.

- Auditable supply chain and transparent lead-time modeling.

Pricing, Risk & Contracting Tactics

Inorganics pricing reflects raw material parity, energy indices, and freight. Contracts should focus on stability and transparency rather than

short-term spot swings. Consider a blended approach: baseline contractual volume with optionality for tactical spot purchases.

Recommended Tactics

- Band Pricing: Volume brackets with pre-agreed lead times and surcharges for expedite scenarios.

- Indexation: Where appropriate, tie part of the price to energy or freight indices with caps/floors.

- Service-Level KPIs: On-time delivery, CoA accuracy, documentation turnaround, complaint responsiveness.

- Quality Clauses: Clear acceptance criteria, retention samples, and corrective action timelines.

For multi-site manufacturers, synchronizing specifications and release criteria across plants prevents unintended variability and simplifies inventory pooling.

Sustainability & Future Outlook

Sustainability priorities are reshaping procurement scorecards and product design targets. Expect increasing requests for emissions data, packaging

recyclability, and water stewardship disclosures. Within food and technical segments, formulation efficiency (achieving the same performance at lower dosage)

and process intensification (less energy per ton of product) will be recurring themes.

Emerging Directions

- Cleaner Utilities: Suppliers transitioning to lower-carbon power inputs to reduce product footprint.

- Closed-Loop Water: Effluent treatment and reuse initiatives at manufacturing sites.

- Smart Packaging: Enhanced moisture barriers and pallet stability to extend shelf life and reduce waste.

- Data-Rich CoAs: More analytics (e.g., PSD curves, impurity profiles) to support process optimization.

Bottom line: SAPP and TSPP will continue to be essential, with growth skewed to quality-sensitive applications and process-efficiency wins.

FAQ for Buyers

Q1: How should I choose among SAPP 15, 28, and 40?

Match the leavening profile to your processing window: SAPP 15 for faster systems, SAPP 28 for balanced release, and SAPP 40 for delayed release.

Validate in pilot trials with your flour specifications, mixing times, and oven curves.

Q2: When is TSPP preferable over other dispersants?

Use TSPP when strong sequestration and deflocculation are required—e.g., high-solids ceramic slips, detergent powders/liquids needing soil dispersion,

and water treatment where scale control benefits from phosphate complexation.

Q3: What documentation should I request for food-grade SAPP?

CoA per lot, TDS, SDS, food-grade declaration, allergen/GMO statements, certificates (Kosher/Halal if needed), and contaminant statements.

Request a change-control policy and retain samples for audit trails.

Q4: How can I reduce total cost-in-use?

Optimize grade selection and particle size, ensure controlled moisture exposure in storage/handling, and perform plant trials to tune dosage.

Engagement with supplier technical teams often yields double-digit efficiency gains.

Q5: What pack sizes are typical?

25 kg multiply bags are standard; bulk users may prefer FIBCs (e.g., 500–1000 kg). Confirm palletization, liner types, and humidity controls for your climate.

Why Partner with GJ Phosphate

GJ Phosphate supplies industrial phosphate solutions with a focus on consistency, documentation, and application engineering. Whether you require

food-grade SAPP for bakery, or technical-grade TSPP for dispersing and water conditioning, our teams align product selection with your process window

and quality targets.

Application-Matched Grades

From SAPP 15/28/40 to TSPP powder/granular forms, we calibrate specifications for your intended function and plant conditions.

Documentation-Ready

CoA, TDS, SDS, and regulatory support letters; supplier questionnaires completed promptly for audits and onboarding.

Reliable Logistics

Flexible packaging, stable lead times, and forecast-based allocations to protect your production plan.

Contact GJ Phosphate

Explore Solutions

Need assistance with a current formulation or line trial? Our technical team can review process parameters (pH, temperature, PSD, solids loading)

and propose adjustments to stabilize performance at lower total dosage.