Market trends: multi-dimensional growth drivers

According to the latest industry data, the global sodium acid pyrophosphate (SAPP) market is witnessing a robust growth cycle.The global food-grade SAPP market size reached USD 260 million in 2024 and is expected to exceed USD 313 million by 2031, at a compound annual growth rate (CAGR) of 2.7%. In industrial applications, the growth momentum is even stronger, with an annual growth rate of more than 5.6%, and the market size is expected to climb from $4.45 billion in 2022 to $7 billion in 2030. This growth is driven by three core factors:

- Revolutionary demand in the food industry: As a multifunctional star in the field of food additives, SAPP’s application value has been continuously explored as a highly efficient bulking agent in bakery products, as a water-holding agent and texture improver in meat processing, and as a stabilizer in beverages. Global consumption of processed foods is surging, especially in emerging economies, driving demand for food-grade SAPP to account for more than 60% of the overall market share.

- Acceleration of green industry: Under the background of tightening environmental protection policies, SAPP is increasingly widely used as a heavy metal chelating agent in water treatment, as a water softener in detergent industry, and as a glaze stabilizer in ceramic production. Industrial-grade SAPP now accounts for 70% of the global supply, becoming the fastest-growing sub-category.

- Upgrading driven by technological innovation: Leading global enterprises are investing heavily in the research and development of high-purity SAPP and environmentally friendly production processes*, enhancing product performance through advanced processes such as multi-stage crystallization technology and membrane separation technology, and reducing energy consumption by more than 30 per cent. China and other traditional producers are gradually narrowing the gap with the international advanced level through technology introduction, digestion and absorption.

Global Demand Hotspots: Regional Market Insights

Asia Pacific: Global Growth Engine

Asia-Pacific region accounts for more than 45% of the total global SAPP consumption, and is a well-deserved demand center. As the world’s largest producer and consumer, China’s demand is expected to exceed 1.5 million tons in 2025, up 50% from 1 million tons in 2019. Behind this phenomenal growth is the expansion of the food processing industry, a growing middle class, and the popularization of packaged food consumption habits. Japan and South Korea, on the other hand, are focusing on high value-added food-grade SAPP, which require high purity and functionality and are highly dependent on imports. Southeast Asian countries such as Vietnam, Thailand and Indonesia have become emerging potential markets as urbanization accelerates and SAPP annual growth rate remains above 7%.

North American market: mature and stable

The U.S., as the world’s second largest SAPP producer, is expected to reach 400,000 tons in 2025. The U.S. market is characterized by stable demand and strict specifications, with particular emphasis on SAPP compliance in organic food applications. The Canadian and Mexican markets form a close supply chain relationship with the U.S. Together, the three countries constitute the North American market segment that accounts for 25% of the global share.

Europe: a quality-oriented market

Europe accounts for about 20% of the global SAPP market, with Germany, France and the UK being the core demand countries. The European market has the most stringent requirements for product standards, with particular emphasis on environmentally friendly production certifications and traceable supply chains. With the advancement of the EU’s “farm-to-fork” strategy, the demand for SAPP products that meet clean label requirements is surging, prompting local companies to develop specialty formulations with low residue and high purity.

Emerging growth poles: multiplying

The Middle East and Africa region is becoming an emerging market that cannot be ignored, especially the Gulf States, South Africa and Turkey, with an annual growth rate of more than 5%. The main demand in these markets is centered on industrial-grade SAPP, which is used in the construction of water treatment facilities and the development of the food processing industry. Latin America is centered on Brazil, where demand for SAPP in the meat processing industry continues to be strong.

Global SAPP Demand Drivers Comparison:

– Food Industrialization: Asia Pacific > Latin America > Middle East

– Strictness of environmental policies: Europe > North America > Asia Pacific

– Demand for high-end products: North America > Europe > Japan/Korea

– Growth Potential Index: Southeast Asia > Middle East > Africa

Competitive landscape: global supplier matrix

Based on product positioning, technical strength and market share, the global SAPP major players are:

– ICL Phosphate Specialty: The global leader in food-grade SAPP, mastering high-purity production technology.

– Innophos: the largest supplier in North America, covering the full range of SAPP specifications.

– Prayon: European advocate of environmentally friendly SAPP, with leading recycling technology.

– Aditya Birla Chemicals: Market leader in India and Southeast Asia.

– Budenheim: European specialist in specialty phosphates

-Chengxing Industrial Group: China’s export-oriented enterprise with market coverage in 40 countries.

– Guizhou Lvyin Biotech: Specialized in food-grade SAPP.

Innovation frontrunners are reshaping the competitive landscape through three main strategies:

- product differentiation: developing specialized formulations for segments such as bakery, meat, and frozen foods

- Green manufacturing: Investing in energy-efficient equipment and wastewater recycling systems to respond to carbon neutrality goals.

- supply chain resilience: establishing regionalized production bases to avoid geopolitical risks.

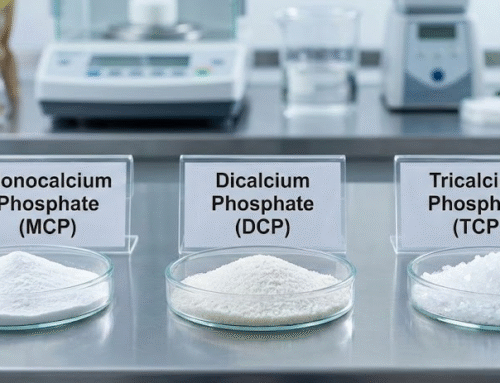

Product Diversification: SAPP Specification and Application Matrix

Innovative directions for food-grade SAPPs:

– Clean label: meeting consumer demand for “simple formulas”

– Non-GMO certified: to meet high-end market access requirements

– Organic compliant: Expanding the market for high value-added organic food products.

– Functionality Enhancement: Developing complex formulations with antioxidant properties.

Technical breakthrough in industrial grade SAPP:

– High purity electronic grade: for semiconductor cleaning process

– Nanostructured SAPP: Improving heavy metal adsorption efficiency in water treatment

– Slow-release formulations: Extending the duration of fertilizer in agricultural applications

Future Outlook: Capturing a New Era of Growth

With the acceleration of global food industrialization and the upgrading of environmental technologies, the SAPP market will see structural growth opportunities. Three major trends are particularly noteworthy:

- Sustainable production transformation: Leading companies are investing in zero-emission processes, reducing energy consumption by more than 30% through multi-stage crystallization and membrane separation technologies, and reusing 95% of wastewater. China’s “14th Five-Year Plan” clearly requires the phosphate industry to reduce energy consumption by 20% by 2025, which will promote the industry reshuffle.

- Fission of application scenarios: In addition to the traditional food processing field, SAPP application breakthroughs in emerging fields such as plant meat texture improvement, 3D printing food structure support, and lithium battery cathode material preparation will create brand new growth points.

- Supply chain restructuring: geopolitical factors are driving the rise of regionalized procurement, and the near-shore production model is favoured. The establishment of localized production capacity in North America and Southeast Asia has become a common strategy for international giants.

For industry participants, the following strategic actions are critical:

– Establish technical barriers: develop patented production processes and specialty formulations

– Obtaining international certifications: obtaining ISO, HACCP, KOSHER, HALAL and other global certificates.

– Expand into emerging markets: establish production bases and distribution networks in Southeast Asia and the Middle East.

– Deepen circular economy: invest in phosphorus recycling technology to realize closed-loop resource utilization.

Multi-specification strategy is becoming the core competitiveness of SAPP suppliers – from the standard SAPP 28 to the special SAPP 10 and SAPP 40 series, to accurately meet the functional requirements of different application scenarios, in order to win the first opportunity in the 100 billion market.

We provide international standard food grade/industrial grade SAPP series products and SAPP full specification solutions, supporting customized development and global supply chain services, helping you to accurately penetrate into high-growth market segments! Contact us now at [email protected]

Sourcing Link:

1. Mordor Intelligence Report:

[https://www.mordorintelligence.com/industry-reports/food-phosphates-market]

2. Grand View Research Report:

[https://www.grandviewresearch.com/industry-analysis/industrial-phosphates-market]

3. ACC Phosphate Report:

[https://www.americanchemistry.com/content/download/7897/file/ACC-Phosphate-Supply-Chain-2024.pdf]

4. Food Phosphates Market:

[https://www.statista.com/outlook/cmo/food/food-ingredients/food-additives/food-phosphates/worldwide]

5. EUROSTAT Chemical Statistics:

[https://ec.europa.eu/eurostat/databrowser/view/DS-066341__custom_7894567/bookmark/table?lang=en]

6. ASEANStats Database:

[https://data.aseanstats.org/dashboard/chemical-trade]